Connecticut CPA Magazine Excerpt - Effective Automation and AI Implementation: Standing Firm in Efficiency Accounting and Advisory Services and Organization for Client Advisory Services

June 26, 2024

By Patrick Ball, CPA – Director of Technology, Innovation, and Partnerships, Aprio

In the midst of the generative Artificial Intelligence (AI) hype, automation often takes a backseat, with the assumption that AI will solve our problems. However, effective automation and AI implementation are impossible without proper processes, technology, and organization. Keeping this in focus, we’ll explore tools to help your firm achieve its goals and foster a healthy work-life balance for your team.

Starting the Process with a Customer Relationship Management System

The initial step is engaging a client in the sales process. The effective way to track clients through this process is with a Customer Relationship Management (CRM) system like HubSpot or Salesforce. Utilizing these tools to track key data points including contact information, number of touches, and stages provides for both statistical insights and understanding of the client’s story with the firm.

CRM systems have become vital tools for large and medium-sized firms. Using the tools built into systems like HubSpot and Salesforce will allow you to send marketing materials to your clients and potential clients. Tracking what services a client has signed up for will allow you to focus your efforts on what they could need in the future from the sales point of view. Additionally, you can make notes about what services your clients passed on to avoid any unwarranted sales attempts.

One of the biggest benefits of a CRM system is the automation it will afford you. You may have heard that “how you start is how you finish.” Utilizing a CRM tool gives you a head start. To help some of the data flow correctly into your system, using contracting software like PandaDoc ensures you capture key pieces of information in your contracts that will automatically flow into your CRM.

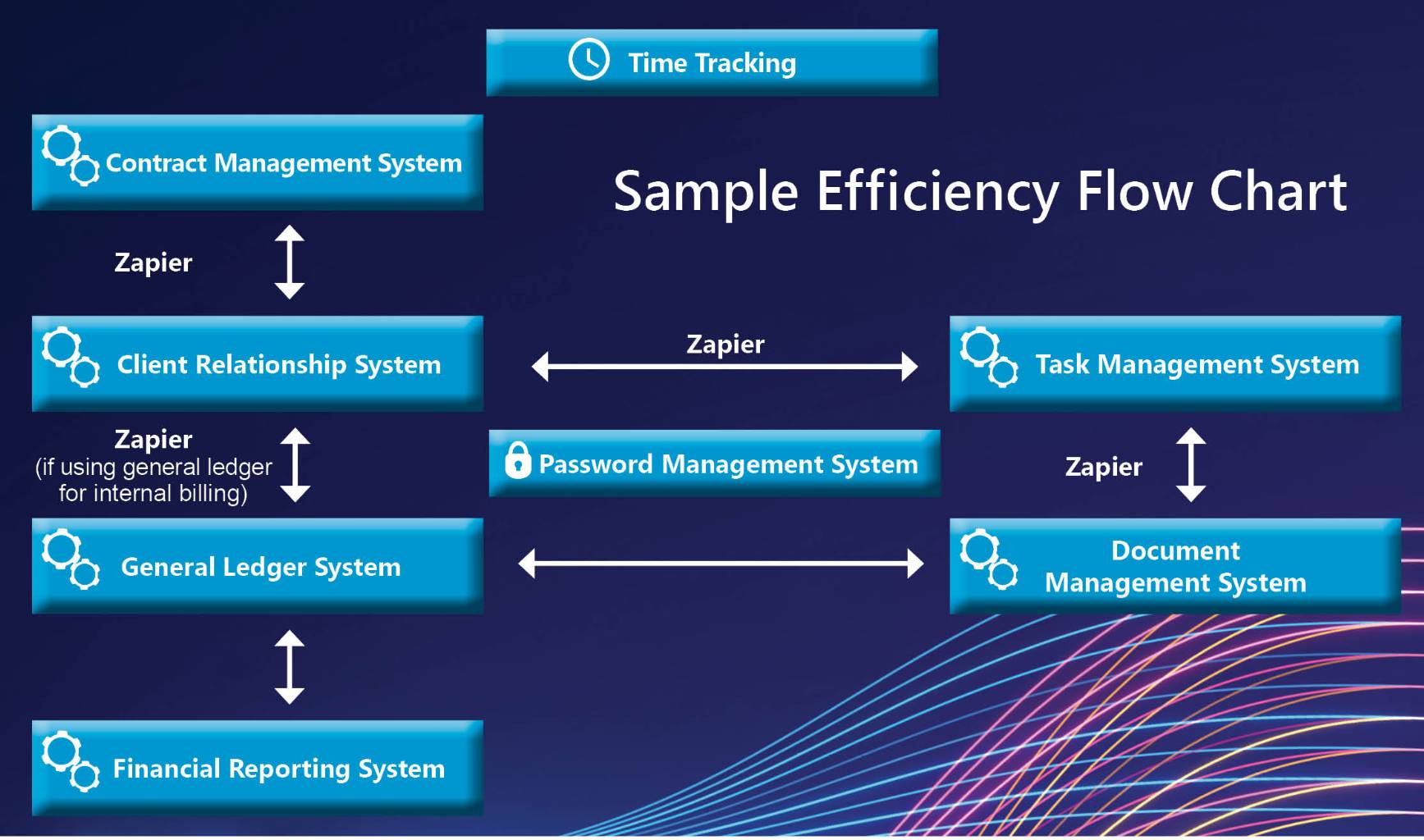

Integrating Systems

Think we are ready for the general ledger system? Nope, not yet! First, we need to “automate to be great.” As we will discuss later in this article, some task management software has built-in integrations with CRM systems. This makes getting all the correct information from one system to the next much more accurate.

Depending on the sophistication of the systems, you can add dynamic aspects to the automation to select appropriate templates for the services sold.

If integrations are not inherently available in the CRM and chosen task management software, you can always use a no-code application like Zapier to integrate these systems. Zapier operates in a way that makes it easy for anyone to write automation. While a CPA by trade, I was able to learn Zapier quickly and apply it to create efficiency in our communications.

Zapier is a unique software that drives automation across many different tools. When I think of Zapier, I think of it as the internet’s duct tape. It can connect many applications and make them work together very efficiently.

Initially, I utilized Zapier to transfer data from our CRM into our task management system. Then, I broadened the application to include our contracting system, document storage, email, and beyond. To guide our automation

priorities, I often pose the question to my team: “What tasks are we manually repeating?” This prompts them to identify areas where automation can free up time.

To start using Zapier, simply visit their website and sign up. I found it beneficial to explore and experiment with Zapier and both my skills and my team’s proficiency improved over time.

Tracking Tasks with Precision

When considering client accounting and advisory services, it’s crucial to track details with precision due to the rapid pace of activities involved. Zapier can be invaluable in this regard by seamlessly pushing information into your task management system.

Tax and audit typically have larger systems that operate at a project level, focusing on each client’s annual filing. Depending on the scope of your client accounting and advisory services engagements, you could be performing tasks monthly or even weekly. This integration enables you to effectively keep pace with the demands of the workload.

It is always easier to build up than to dig for something that may not be there. When thinking about a task management system, if it does not have tasks (digging for something that isn’t there), you may not be able to track the work appropriately.

An appropriate task management system creates a certain efficiency in your communications that removes unnecessary conversations and allows for clear expectations.

In the past, I have leveraged several task management systems for this purpose: Asana, ClickUp, and Monday. Each of these systems integrates with different CRMs through Zapier. The integrations between these systems can ensure your projects are all in accordance with the scope of the firm’s contracts.

As we think of the rapid pace of accounting and advisory services work, utilizing a task management system allows us to create a due date for every task in the process. Whatever your required level of review, this can be set up.

You can schedule your data entry team complete reconciliations by the 5th of the month, your senior accountant review by the 10th, the manager review by the 15th, and you can send the financials by the 20th. Plus, you can analyze your team’s client load by due date to ensure the proper mix of clients, so no one is overwhelmed at a given point in the month.

Choosing the correct task management system for you and setting it up appropriately is a critical step to getting work done at a good margin. Much of people’s time is lost in internal communication. Task management systems answer who, what, when, and how, and provide updates along the way.

Leveraging General Ledger Systems

Now, let’s discuss the general ledger system. I advocate for a cloud-based system. This enables all team members, regardless of location, to access information and perform tasks with relative ease. A cloud-based system facilitates access to top talent that aligns with your firm’s needs.

Intuit and Xero offer multiple versions of their products, most of which support cloud-based work and enhance efficiency for your team. Both systems automatically import transactions for many banks through their software. When the data is present, it makes the work more effortless.

Bank rules can be leveraged to automatically categorize transactions appropriately as the data comes in. Additionally, having hard bank reconciliations with documentation in each of these systems allows for an appropriate check for the review team.

Constantly having transactional data pushed into your general ledger system and being categorized is one of the best things you can do for a smooth tax season. Why wait until the busiest time of the year to do a year’s worth of work? Maintaining a system that keeps your client’s books updated is crucial for both your clients and your team. It ensures you have the latest data when advising your clients on their business.

Accessing Banking Data

As mentioned earlier, automating accounting and advisory services work heavily relies on the automatic import of bank transactions. While the general ledger systems import transactions, importing bank statements is a relatively new feature and is not supported by every bank.

It is important to have access to your client’s bank, credit card, and loan accounts. Most banks offer third-party access that grants your team access to the data, without the ability to move money.

Safely storing this sensitive information is paramount and using a username/password system like LastPass or Keeper is essential. These systems allow controlled access to each client’s login details, ensuring privacy and control within your organization, and

limiting access to authorized personnel only. Both systems allow controlled

access to each client’s login information. This ensures a level of privacy

and control.

Creating Secure, Organized Storage Systems

Clients provide information to their accountants frequently. It is important to have a safe, secure, and organized document storage system. Although Microsoft and Google offer their own storage solutions, platforms like Box provide a secure method for clients to share information with you. Utilizing cloud storage ensures that every team member can access the data regardless of their location.

Remember, even top-notch software, data, and processes can be undone with a lack of organization. Developing a proper folder structure for the client, down to the names of each of the files (e.g. Client Name 1234 Statement – July 2023), will allow for more effective and efficient use of the software. When paired with a proper task management system, it will reduce the effort the team expends when looking for documents a client may or may not have provided.

For example, if files are named in a similar cadence and stored in similar folders across the board, a staff accountant can easily find the document if it has been received. If a document is expected but has not yet been sent by a client, you can leverage the task management system to report the missing item.

Some task management systems offer email as an option that allows for tracking of what others are sending to clients. This prevents asking a client for materials that have recently

been requested or have already been received.

Automating File Sharing with Clients

Many firms still save financial reports into their document management system and then email them to the client. However, there are now much better options than the long and time-consuming process this has become.

Several tools like Fathom sync with QuickBooks Online and Xero daily and allow for a quick-click method to provide custom financial statements to clients. Financial reports can even be scheduled to be sent out on the same day each month.

As you think about scaling and applying consistency in the product that your clients see from you, a tool like Fathom becomes increasingly critical. With the ability to use the same template on multiple locations, the consistency of your deliverables will improve.

Fathom also offers the ability to compare clients on your platform to each other in benchmark groups. This provides key insights for your advisory team to discuss with each client. As you grow, tools like this will allow you to move from accounting work to more advisory work.

Tracking Time and Billing

Lastly, it’s critical to implement a system for tracking the time spent on each client. While there are differing perspectives on billable hours in client accounting services, I view it as a capacity goal.

By utilizing a task management system and establishing estimated times per task, you gain a clearer understanding of your team’s capacity. A time tracking system enables you to assess your team’s efficiency and identify clients where too much time is being allocated.

Scope creep can have adverse effects on your margins, particularly with flat fee billing. While flat fee billing eliminates uncertainty about incoming revenue, it places the responsibility for efficiency squarely on the firm. Implementing a time tracking system helps pinpoint areas for improvement.

You have heard “time is money,” and here it is more important than ever. These technologies come with costs. Considering your team’s time as the capacity metric helps quantify the use of these technologies versus hiring more staff for routine tasks.

Comparing entities isn’t always “apples to apples.” If an entity has 10 bank accounts, it will take longer to perform the work on that entity as opposed to one with only one bank account. When considering your firm’s profit margin, would you prefer to invest in more labor or enhance your technology?

Moving Forward

In this article, we’ve talked a lot about systems and technology. Technology is great, but you must design your processes to work with the technology. Technology alone will not be enough.

Having proper processes set up to allow the technology to work together and augment your team will lead to the best possible outcome. Even Tony Stark had to learn how to use the Iron Man suit!

As you think about implementing this throughout your firm, remember you must design your processes to work with your technology. Going forward, I would challenge you to think about what you are doing manually today that is repetitive. This is the low-hanging fruit in the automation world.

Getting the appropriate tech stack in your firm will allow you to automate to be great.

Patrick Ball, CPA is the Director of Technology, Innovation, and Partnership with Aprio’s Managed Services Department. Over the past five years, Patrick has honed his expertise in small business, private equity, and technology, with a particular emphasis on integrating automation and streamlining operations within accounting firms. His dedication lies in empowering clients to achieve financial growth while enhancing the Aprio team through his commitment to process enhancement and automation advancement. He can be reached at patrick.ball@aprio.com.