CTCPA Pursing Alternative Pathways to Licensure

In November, following extensive discussions with the Connecticut State Board of Accountancy (SBOA) and the other New England SBOAs, CTCPA Executive Director Bonnie Stewart presented two proposals to the Connecticut SBOA regarding CPA mobility and pathways to CPA licensure in Connecticut. The Board voted to request that the Connecticut legislature (via CTCPA) adopt the proposals in the coming legislative session.

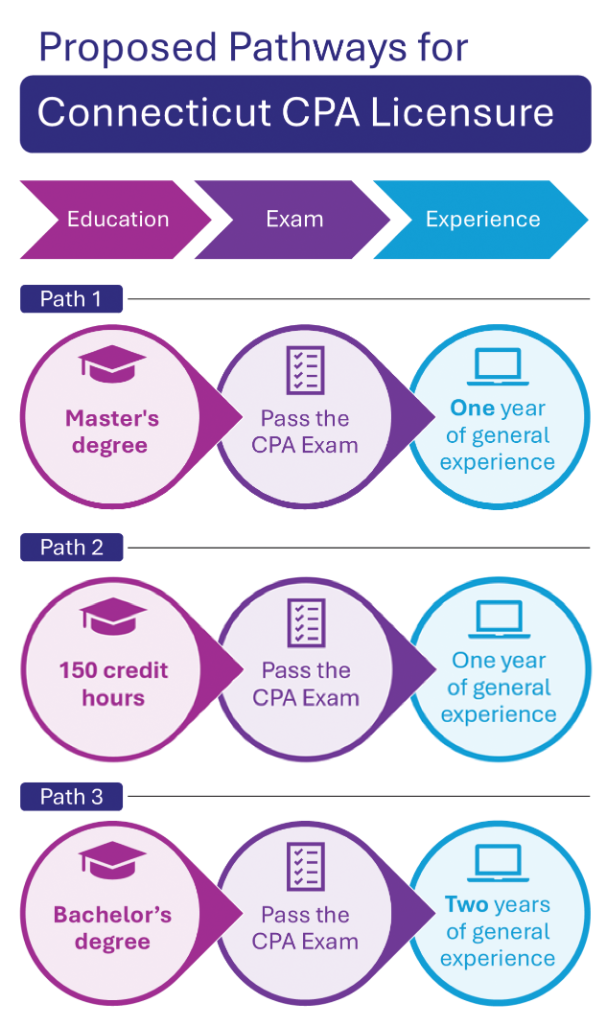

To ensure Connecticut's CPA licensure framework remains inclusive, adaptable, and aligned with the evolving needs of the profession, we propose adopting multiple pathways to CPA licensure. These pathways are designed to broaden access to the CPA credential by recognizing diverse educational and experience backgrounds without compromising the rigorous standards of the profession.

Proposed Pathways

Our proposed framework offers three pathways to CPA licensure:

- Pathway 1: Master's degree, passage of the CPA Exam, and one year of general experience.

- Pathway 2: 150 credit hours, passage of the CPA Exam, and one year of general experience.

- Pathway 3: Baccalaureate degree, passage of the CPA Exam, and two years of general experience.

As for education, each pathway requires an:

- Accounting degree, or

- Non-accounting degree plus accounting-related courses.

Accounting degree is defined as a degree that includes "accounting" in the title or a business degree with a concentration in accounting, such as accounting minor, accounting emphasis, or accounting concentration. This degree-centered approach simplifies the educational requirements, helping reduce administrative burdens on candidates and regulatory bodies.

Rationale for Modernized Pathways

Clarity and Transparency: We can simplify educational requirements without lowering standards by defining "accounting degree" as stated above. This clarity reduces confusion for candidates, enabling them to easily navigate the pathway options.

Expanding Diversity and Helping Address Pipeline Shortages: Providing multiple pathways helps eliminate barriers to the profession, assist in addressing talent shortages, and expand diversity. Providing multiple paths to licensure makes the CPA profession more accessible to candidates from various educational and experiential backgrounds.

Conclusion and Request

The alternative pathways approach aligns Connecticut with broader efforts to alleviate talent shortages in the profession and increase the diversity of the candidate pool. This is all done while maintaining a licensure system that focuses on the three Es (education, exam, and experience), thereby not reducing the value of the CPA credential.