CTCPA Career Guide

Recruit staff and interns with our new interactive online hiring directory!

As recruitment and retention remain a top challenge for our members, we're excited to introduce our new Career Guide! Many of you may remember CTCPA's Guide to Connecticut Accounting Employers, a print booklet featuring organizations hiring interns and full-time hires in Connecticut. We paused publication of the guide when COVID restrictions made it difficult to distribute a print piece in classrooms and at career fairs.

As part of our commitment to continuously upgrade and enhance our technology, we're thrilled to introduce the new, completely digital Career Guide.

Get your company listed.

Recruit potential employees by showcasing your company in the Career Guide! Purchase a one-year subscription for $420 or a one-year featured listing for $840.

Only CTCPA company administrators can add their companies to the Career Guide. Need company administrator rights? We'd be happy to help. Contact membership@ctcpas.org or dial 860-258-4800 and press 2 for the membership team.

Search for the perfect company.

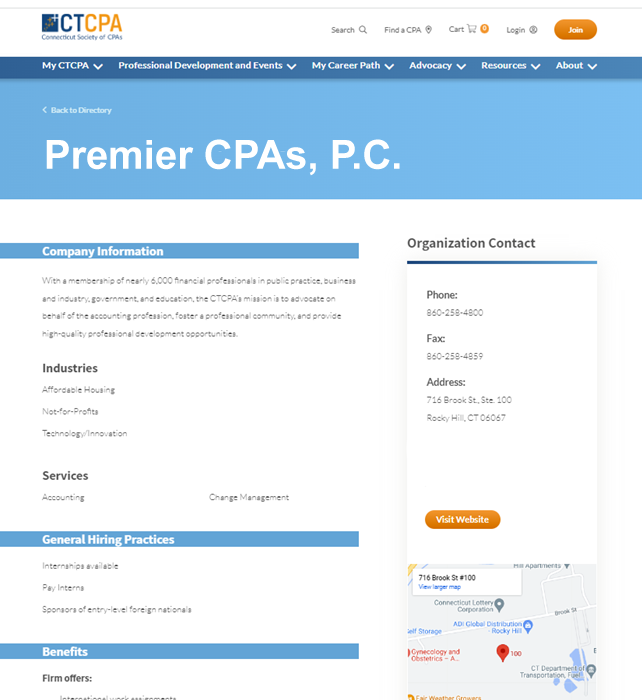

Whether you're seeking an internship or a full-time position, our interactive directory will help you find your career fit by searching for companies by location, benefits, staff size, and more.

You can also use the "compare" feature to review up to three organizations side-by-side – easily find the niche areas and benefits you're looking for.

New benefits to the digital format:

- Easy, real-time updates. Hiring companies can log in and update their listings at any point throughout their one-year subscription to add new office locations, benefits, etc.

- Search and compare features. Potential employees can search for hiring organizations based on their interests and priorities and can select up to three organizations to compare side-by-side.

- Wider distribution. This interactive format will make it even easier to reach a broad audience of job and internship seekers and those who mentor them including students and educators, career counselors, CPA candidates and those newly certified, individuals in career transition, and more.

- Ability to spotlight your organization. Purchasing a featured listing will highlight your company at the top of search results.

Firms, companies, not-for-profits, and other hiring organizations can purchase a one-year listing in the online Career Guide. The listing will include a comprehensive overview of the organization, what types of individuals it seeks to hire, employee benefits and perks, why a new hire should consider working there, and more.

Complete the Career Guide form and click "Purchase." Check the box to indicate if you're selecting a basic one-year listing ($420) or a featured listing ($840), which will pin your company to the top of search listings, and click "add to cart." Complete the checkout process to get listed - it's that easy!

Only CTCPA company administrators can add their companies to the Career Guide. Need company administrator rights? We'd be happy to help. Contact the CTCPA at 860-258-4800 or membership@ctcpas.org.

Only CTCPA company administrators can add their companies to the Career Guide. Need company administrator rights? We'd be happy to help. Contact the CTCPA at 860-258-4800 or membership@ctcpas.org.

The Career Guide is now offered exclusively online, as more students and young professionals are using the internet to conveniently find career information. The online Guide is interactive, allowing visitors to compare firms and search based on their interests.

Whether you purchase a basic listing or featured listing, your listing will be active for one year from the date of purchase. You will receive an email before your listing expires to remind you to renew.

You can update your listing at any time via the Career Guide form - just be sure to click "Save" and your changes will show online immediately.

Yes, they are separate - but you can certainly be listed in both, and we encourage you to do so!

The Find a CPA Directory is where firms advertise their business to potential new clients; this benefit is available free of charge to all CTCPA members.

Enlist in or update your Find a CPA listing

The Career Guide (which is a paid service) is designed for firms to reach future new hires, whether it's for internships or employment. While some of the information from your company's Find a CPA listing will trickle through to your Career Guide listing, there are a number of additional fields that will appear on the Career Guide, including what benefits your company offers to employees.

Purchase your subscription or update your Career Guide listing

If you have questions, contact the membership department at membership@ctcpas.org or call 860-258-4800 and press 2.

News

AICPA releases expanded plan for addressing CPA pipeline challenges

May 17, 2023

The AICPA released an expanded plan Thursday focused on boosting the profession's talent pipeline. The detailed plan features input from a significant set of stakeholders and calls for those stakeholders to work together to increase the number of accounting graduates and the number of graduates who obtain CPA licensure.

70% of Gen Z Employees Would Switch Jobs for Better Tech: Weekly Stat

May 10, 2023

CFOs who want to retain Gen Z employees — a group that will make up more than a quarter of the workforce by 2025 — should embrace technology.

Create a magnetic culture at your firm

May 10, 2023

Our profession has in front of us the greatest opportunity for increased relevance and abundance that I have seen in 40 years. Demand for our services, skill sets, and leadership have never been higher. We can simply look at the growth percentages from the latest 2022 large firm reports and see that firms are growing at much faster rates due to this increased demand.

Less is more when it comes to the workweek, UK research finds

May 03, 2023

A large four-day workweek trial finds that companies and employees benefited from reduced hours and some companies plan to continue with a shorter workweek.

IRS highlights information and free resources in recognition of National Small Business Week

April 28, 2023

As part of National Small Business Week, April 30 to May 6, the Internal Revenue Service is highlighting tax benefits and resources to help those looking to start a business.

NASBA Extends CPA Exam Testing Window to 30 Months

April 24, 2023

In response to feedback submitted through the exposure draft, NASBA has announced that it will adopt an increased testing window of 30 months.